There are tons of intricacies connected with the whole world of gold, silver, along with other precious metals.

Quality Gold for an IRA: Not all gold qualifies, normally those who are ninety nine.five% pure or better are best. Most investors usually favor coins issued from national mints or bars of this precious metal as investments.

We were being amazed with our customer service interaction at JM Bullion. The agent listened patiently and answered the majority of our issues instantly.

Boost Extensive-Term Interactions: By escalating Trader idea of their Gold IRA’s likely and price, buyers are more likely to retain it for an extended period. Education and learning fosters loyalty and creates Long lasting associations causing referrals for all those IRA companies.

On the other hand, you will find most likely strict stipulations on account longevity and funding thresholds so as to redeem the promotion, so ensure that you thoroughly read through the terms and conditions before getting going with Rosland.

Simply just said, no individual could act as their own custodian for somebody Retirement Account or Gold IRA. In accordance with IRS rules, only competent trustees or custodians are licensed to hold these types of assets – this guarantees compliance with policies and rules though safeguarding both equally account holder interests and governing administration kinds. Analysis gold IRA companies and locate the correct match for your precious metals.

Expenses and charges: As a result of storage and insurance expenditures connected to physical gold ownership, gold IRAs could cost bigger costs than classic IRAs.

IRA companies like Noble Gold may perhaps get rid of light-weight on topics like their performance, Positive aspects, and threats her explanation in addition to variances between standard or Roth IRAs.

Classic IRA: Contributions might be tax-deductible determined by somebody’s revenue and access to an employer-sponsored retirement program; earnings grow tax deferred until finally withdrawals commence (usually just after reaching retirement age).

Knowledge tax rules bordering IRAs can be intricate; always talk to a professional Expert regarding any adjustments you propose on earning concerning their sale, particularly if distributing proceeds will come about.

Generally consult a tax Qualified or financial advisor in creating these crucial options about gold IRA investments.

Our only gripe relating to this firm is usually that, Inspite of remaining in business for practically ten years as well as a half, they continue to haven’t gotten accreditation from your Business Buyer Alliance (BCA).

When you purchase gold make investments wisely, Even though gold and precious metals are arguably safer investments than college student financial loans by way of example.

Our editors are dedicated to bringing you impartial rankings web and information. Advertisers do not and cannot affect our ratings.

Michael Fishman Then & Now!

Michael Fishman Then & Now! Michael C. Maronna Then & Now!

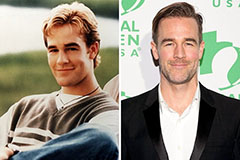

Michael C. Maronna Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!